“Tech Giants Amazon and Meta: A Collective Surge of $280 Billion in Market Cap”

Introduction:

In a remarkable demonstration of financial strength, Meta Platforms Inc. and Amazon.com Inc. recently witnessed a significant upswing in their stock market values, jointly gaining an impressive $280 billion post their quarterly results. This outstanding performance not only highlights the resilience of these tech behemoths but also signifies a notable shift in investor sentiment within the technology sector.

Thank you for reading this post, don't forget to subscribe!

Meta’s Meteoric Ascent:

Meta Platforms Inc., formerly known as Facebook, took the lead with an impressive 14% surge in its stock price, hitting a record high of $451. This surge propelled Meta’s market capitalization by a noteworthy $148 billion, reaching a monumental $1.16 trillion. The driving force behind this surge was Meta’s exceptional financial performance, with a 25% increase in revenue for the December quarter, totaling $40.1 billion. Robust advertising and device sales played a pivotal role, showcasing the company’s diversified revenue streams.

Amazon’s Rise to Prominence:

Not to be overshadowed, Amazon.com Inc. witnessed an 8% uptick in its shares following a revenue performance that surpassed expectations for the December quarter. This surge added a substantial $110 billion to Amazon’s market capitalization, propelling it to an impressive $1.78 trillion. The positive market response is a testament to Amazon’s consistent ability to meet and exceed market expectations.

Diverging Fortunes:

Apple’s StumbleThe stellar performance of Meta and Amazon sharply contrasts with Apple Inc., which experienced a decline in its stock value by $70 billion. Apple’s setback was primarily attributed to sales in China falling short of estimates. This divergence in fortunes underscores the dynamic nature of the technology sector, where individual company performances significantly influence market dynamics.

Impact on CEO Net Worth and Strategic Plans:

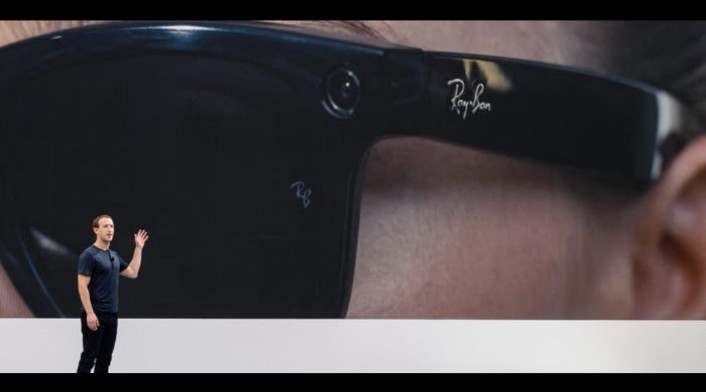

Mark Zuckerberg, CEO of Meta, witnessed a substantial increase in his net worth by $28.1 billion, reaching an impressive $170.5 billion. This surge positioned him in the fourth spot on the Bloomberg Billionaires Index. Additionally, Meta announced plans for capital expenditures between $30 billion and $37 billion for 2024, indicating a strategic investment in AI with a focus on servers.

Strategic Shift and Shareholder Value:

Meta’s robust financial position prompted the company to announce its inaugural dividend of 50 cents per share and initiate a $50 billion stock buyback. This strategic move signals a shift in Meta’s financial strategy, offering additional value to shareholders and instilling confidence in the company’s future prospects.

Market Optimism and the Role of Generative AI:

The overall market response to the earnings reports of these tech giants reflects investor optimism, particularly in the potential of generative AI. The surge in market capitalization for Meta and Amazon has contributed to the broader rally in related companies operating in the tech space.

Conclusion:

The recent financial successes of Meta and Amazon underscore their adaptability and resilience in the ever-changing tech landscape. As these companies continue to innovate and diversify their revenue streams, the surge in market capitalization serves as a testament to sustained investor confidence in their ability to shape the future of technology. The differing fortunes of Apple, Meta’s strategic plans, and Amazon’s solid financial performance together present a dynamic picture of the ongoing evolution in the tech sector.

I may like your website; however, I would like to bring your attention to the spelling errors present in several of your posts. While I find it extremely difficult to convey the truth, I will surely revisit your site.