The Union Budget 2025 has introduced significant reforms to India’s income tax structure, aiming to simplify taxation and provide substantial relief to taxpayers. With the new tax regime now set as the default, it’s essential to understand its features, benefits, and how it compares to the old system.

Thank you for reading this post, don't forget to subscribe!

Key Features of the New Tax Regime

- Increased Tax Exemption Limit:

Individuals with an annual income up to ₹12 lakh are now exempt from paying income tax. This change is designed to boost the disposable income of middle-class earners, allowing for greater financial flexibility. - Revised Tax Slabs:

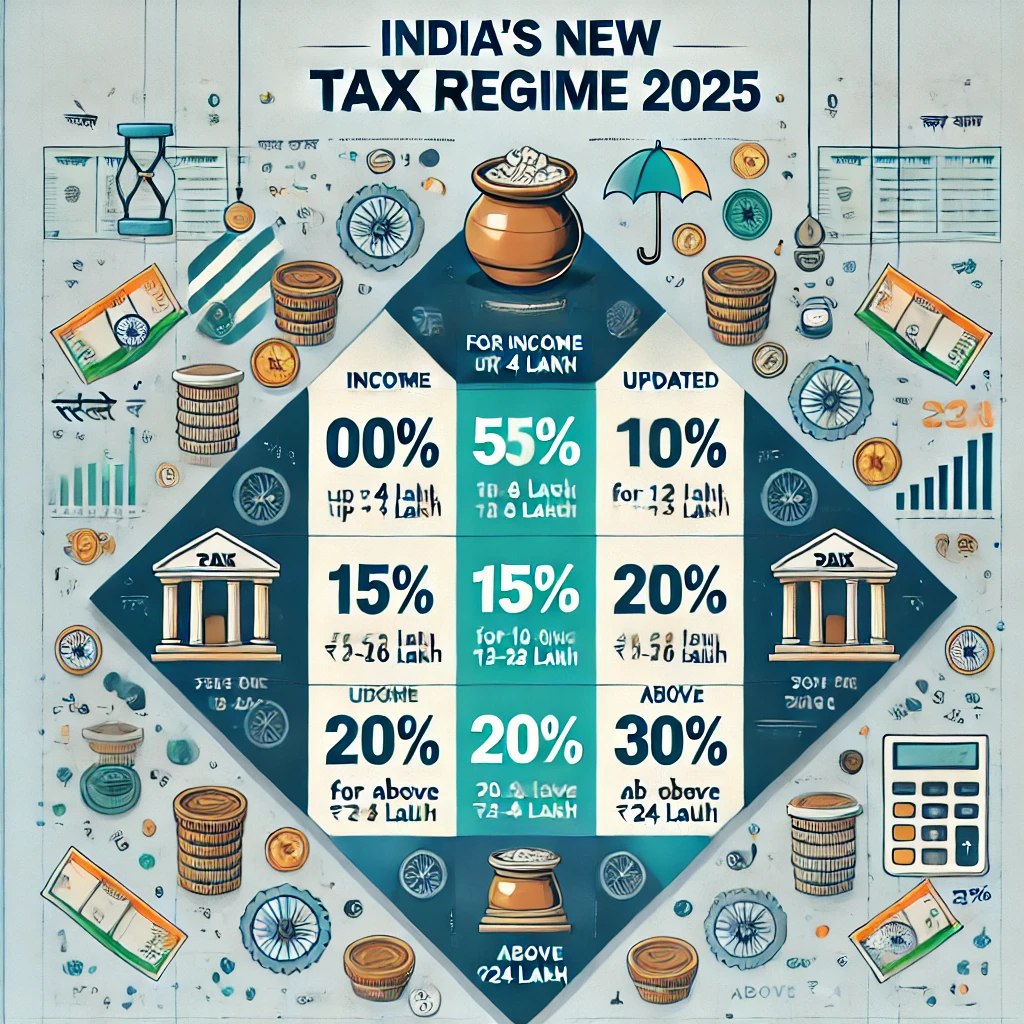

The new regime introduces updated tax slabs to ensure a progressive taxation system:- 0% Tax: Income up to ₹4 lakh

- 5% Tax: ₹4 lakh to ₹8 lakh

- 10% Tax: ₹8 lakh to ₹12 lakh

- 15% Tax: ₹12 lakh to ₹16 lakh

- 20% Tax: ₹16 lakh to ₹20 lakh

- 25% Tax: ₹20 lakh to ₹24 lakh

- 30% Tax: Above ₹24 lakh

- Enhanced Standard Deduction:

The standard deduction has been increased from ₹50,000 to ₹75,000. For salaried individuals, this means that incomes up to ₹12.75 lakh are effectively tax-free, further alleviating the tax load on middle-income earners.

Comparing the New and Old Tax Regimes

While the new tax regime offers lower tax rates and a higher exemption limit, it does not allow for certain exemptions and deductions available under the old regime. Taxpayers must evaluate their financial situations to determine which regime is more beneficial. For instance, individuals with significant investments in tax-saving instruments or those paying substantial home loan interest might find the old regime more advantageous.

Impact on Different Income Groups

- Middle-Income Earners:

Those earning between ₹12 lakh and ₹20 lakh annually will experience a notable reduction in tax liability, resulting in increased disposable income. - High-Income Earners:

Individuals with incomes exceeding ₹20 lakh will also benefit from reduced tax rates, though the percentage of savings may vary based on specific income levels.

Making an Informed Choice

Taxpayers are encouraged to assess their financial profiles, considering factors like eligible deductions, investments, and expenses. Utilizing online tax calculators or consulting with financial advisors can aid in making an informed decision between the new and old tax regimes.

The 2025 tax reforms signify a pivotal shift in India’s taxation landscape, aiming for simplicity and increased taxpayer relief. Understanding these changes is crucial for optimizing tax benefits and ensuring compliance.